Flexible Funding Built for Small Businesses

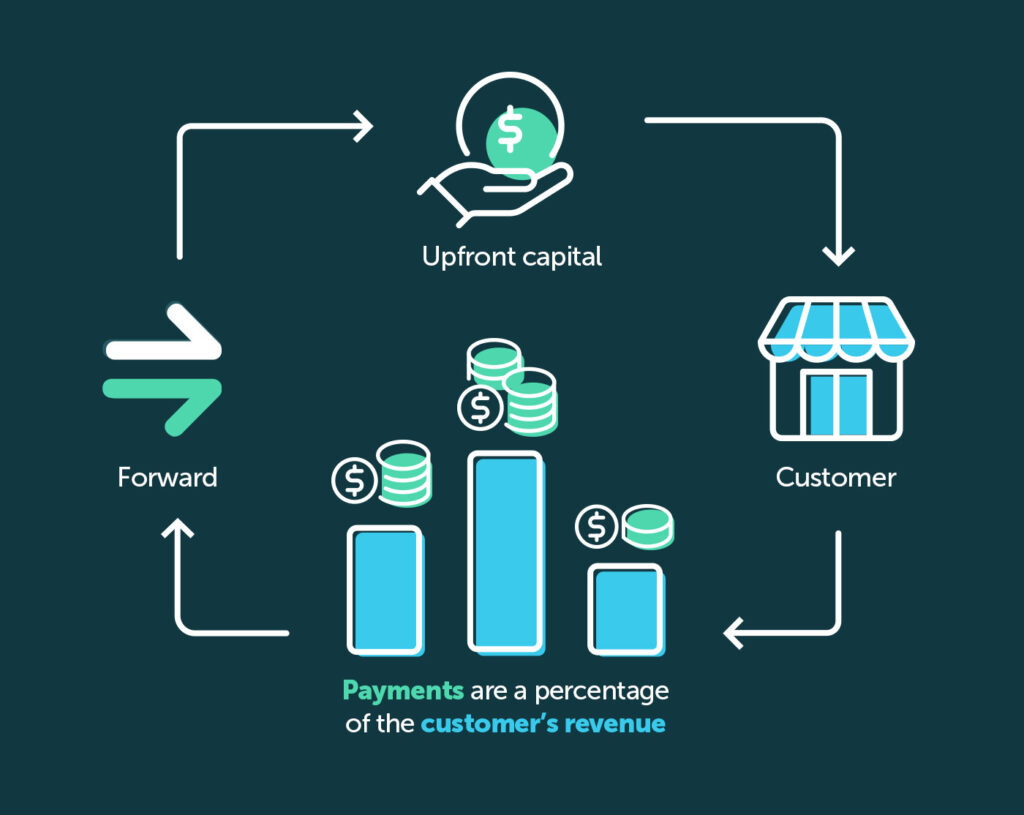

Our product, revenue-based financing, provides upfront capital in exchange for a set amount of the business’s future revenue. Payments are simply a percentage of revenue. So if revenue decreases, payments can too – and the total payment amount stays the same, even if it takes longer to pay.

Key Details:

Apply online in minutes. Get a quick decision. And often receive funding same-day.

Do you meet these simple requirements? If so, your business may be eligible for funding!

Because we specialize in providing capital to small businesses who may not qualify elsewhere or need a convenient, flexible solution, we keep our eligibility requirements simple and attainable. Businesses must be in business in the US for at least one year, make $10,000+ in monthly revenue, and owners must have a 500+ credit score.

Because we specialize in providing capital to small businesses who may not qualify elsewhere or need a convenient, flexible solution, we keep our eligibility requirements simple and attainable. Businesses must be in business in the US for at least one year, make $10,000+ in monthly revenue, and owners must have a 500+ credit score.

Because we specialize in providing capital to small businesses who may not qualify elsewhere or need a convenient, flexible solution, we keep our eligibility requirements simple and attainable. Businesses must be in business in the US for at least one year, make $10,000+ in monthly revenue, and owners must have a 500+ credit score.

Because we specialize in providing capital to small businesses who may not qualify elsewhere or need a convenient, flexible solution, we keep our eligibility requirements simple and attainable. Businesses must be in business in the US for at least one year, make $10,000+ in monthly revenue, and owners must have a 500+ credit score.

Because we specialize in providing capital to small businesses who may not qualify elsewhere or need a convenient, flexible solution, we keep our eligibility requirements simple and attainable. Businesses must be in business in the US for at least one year, make $10,000+ in monthly revenue, and owners must have a 500+ credit score.

Because we specialize in providing capital to small businesses who may not qualify elsewhere or need a convenient, flexible solution, we keep our eligibility requirements simple and attainable. Businesses must be in business in the US for at least one year, make $10,000+ in monthly revenue, and owners must have a 500+ credit score.

Senior Sales Manager, Renewals

As soon as you’re funded, you’ll have access to our self-serve customer portal, where you can see your balance and manage your account at any time. You’ll also be assigned a dedicated Account Executive who is available to help you manage your funding and notify you when you’re eligible for additional financing.

We’re invested in your success beyond providing financing. Our customer engagement team is just a phone call away to help your business succeed.